For a better, faster experience.

Best Forex Trading Apps in India (2025)

The foreign exchange market is the world's largest financial market, growing with time in India. With the rise of retail traders, many are now opting for a forex trading app that supports real-time trading and analysis and ensures secure transactions through their smartphones. But with so many apps and websites out there, which one is the best forex trading app in India?

Our guide brings you a review of the top platforms, giving you their features, safety, ease of use, and broker credibility to help you choose among the top 10 forex trading apps of 2025.

Top 10 Best Forex Trading Apps in India (2025)

| App Name | Regulation | Minimum Deposit | Platform Rating |

|---|---|---|---|

| Zerodha Kite | SEBI | ₹0 | ⭐⭐⭐⭐⭐ |

| FXTM | CySEC, FCA | $10 | ⭐⭐⭐⭐☆ |

| OctaFX | CySEC | $25 | ⭐⭐⭐⭐☆ |

| Exness Trader | FSA, CySEC | $10 | ⭐⭐⭐⭐☆ |

| HFM (HotForex) | FCA, DFSA | $5 | ⭐⭐⭐⭐☆ |

| eToro | FCA, ASIC | $50 | ⭐⭐⭐⭐☆ |

| XM Forex | ASIC, IFSC | $5 | ⭐⭐⭐⭐ |

| TradingView | NA | Free/$15-$60 | ⭐⭐⭐⭐⭐ |

| ICICI Direct | SEBI | ₹0 | ⭐⭐⭐⭐ |

| Angel One | SEBI | ₹0 | ⭐⭐⭐⭐ |

Top 10 Forex Trading Apps in India

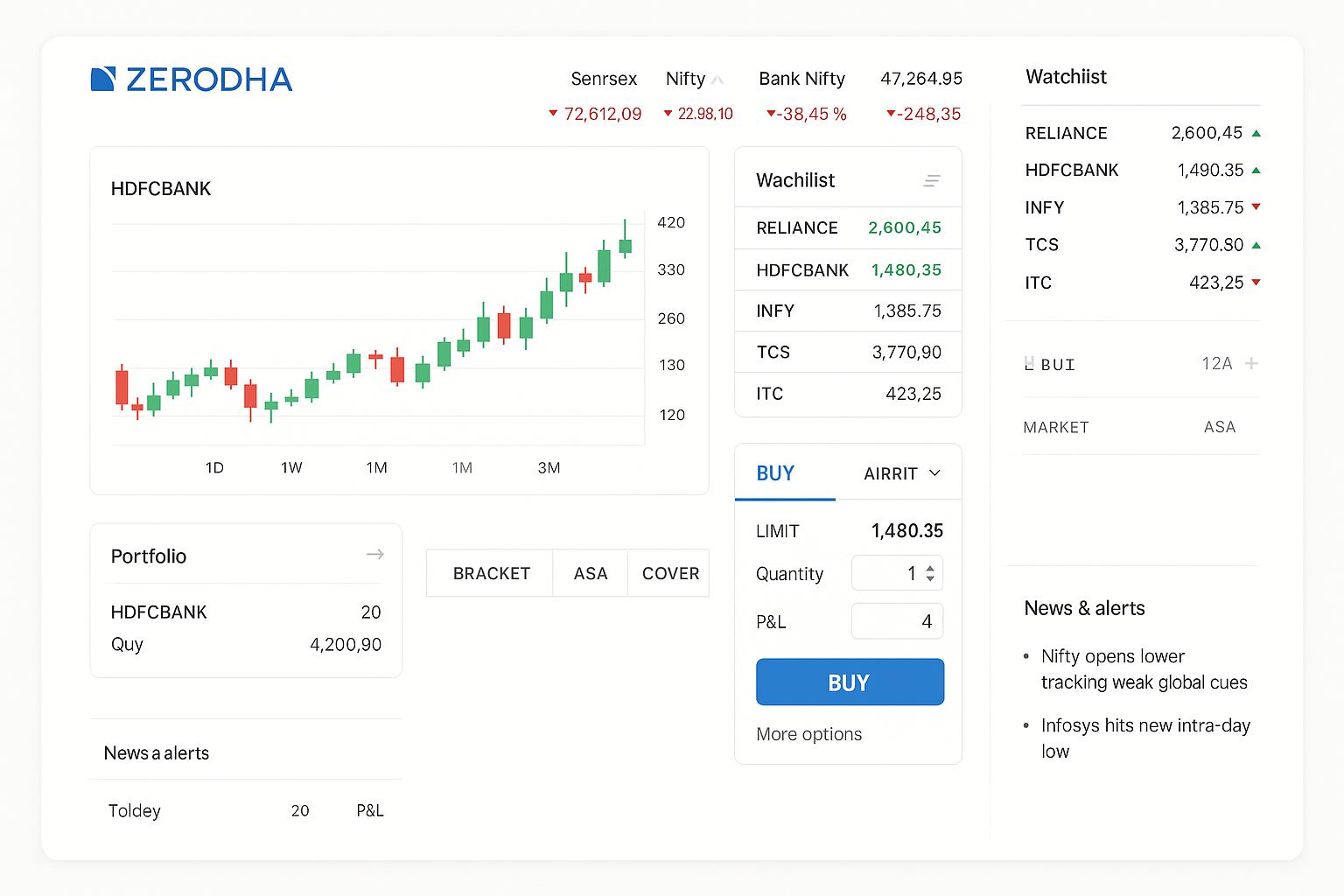

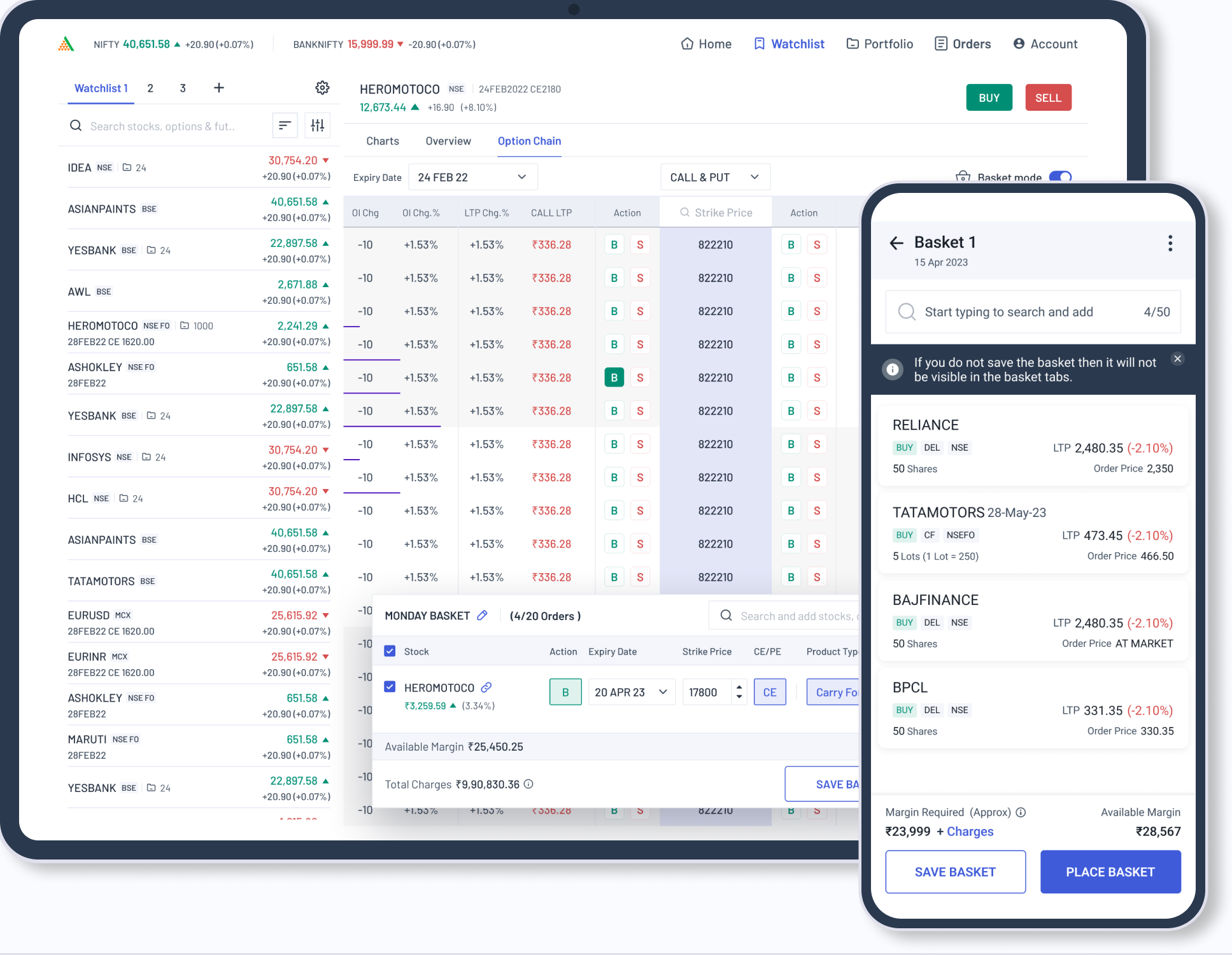

1. Zerodha Kite

Why it Stands Out:

Being one of the country`s most trusted stock trading apps in India, it mainly deals in stock and commodities trading but supports currency derivatives that are regulated by SEBI. Its interface, fast-loading charts, and volume of available data make it easy and reliable for beginners.

Key Features:

Regulated by SEBI

Opening an account is free

Real-time charts with more than 100 indicators

Mobile app is very user friendly

Best For: Beginners and veteran Indian traders in need of compliance and ensuing safety.

Pros:

SEBI regulated (legally safe)

₹0 minimum deposit

Excellent for currency derivatives in INR pairs

Cons:

Only supports INR-based forex pairs (no global pairs)

Lacks MT4/MT5 support

ALSO READ: Top 10 SEBI Registered Telegram Channels in India (2025)

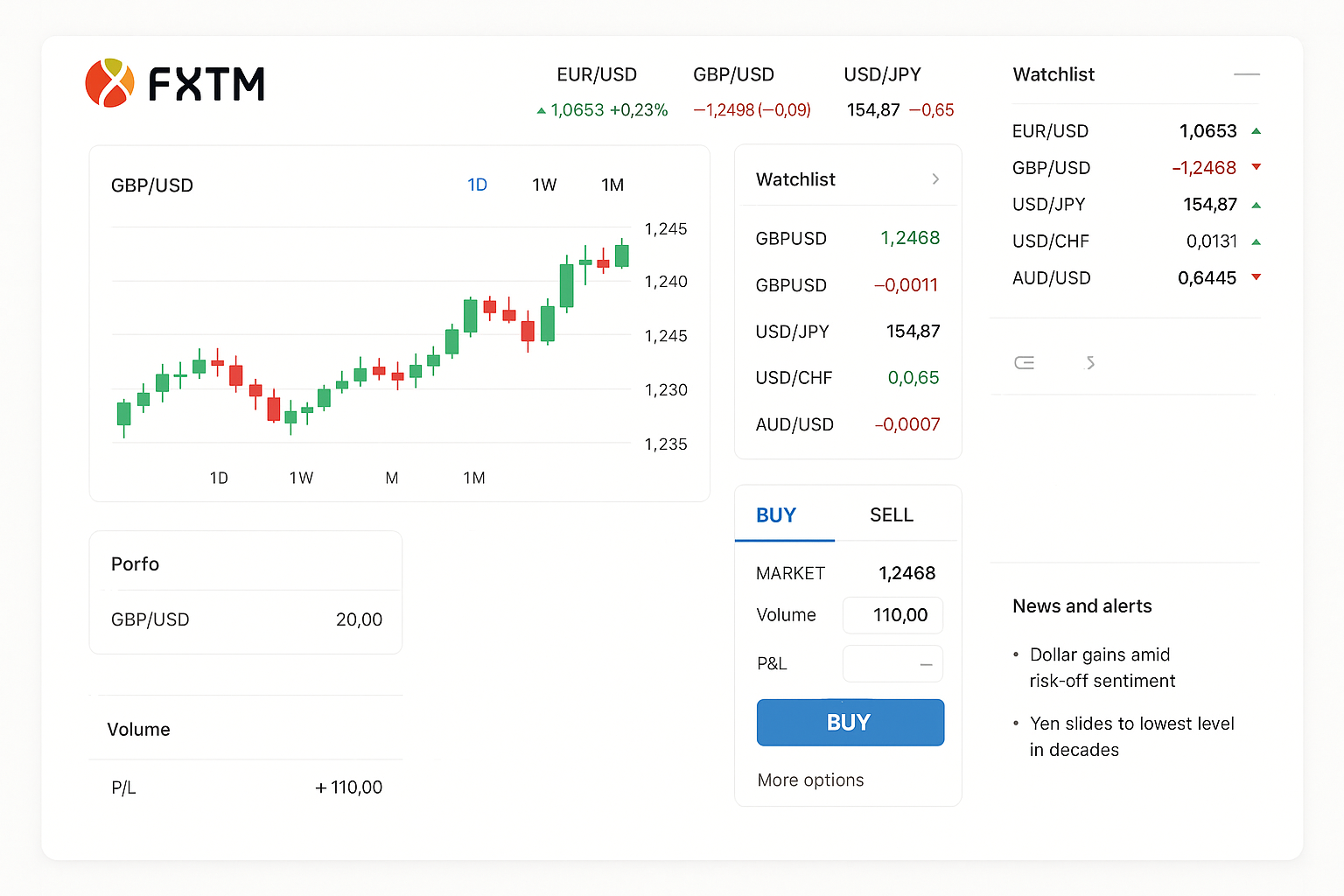

2. FXTM (ForexTime)

Why it Stands Out:

FXTM is internationally recognized for the user-friendly mobile application and lightning-fast order execution. With numerous account types and training materials offered, FXTM is suitable for Indian traders wanting global exposure.

Key Features:

Regulated by CySEC and FCA

Offers both MetaTrader 4 and 5

Local deposit and withdrawal options

Copy trading option

Best For: Forex traders at an intermediate and experienced level looking for a global perspective.

Pros:

Globally regulated (CySEC, FCA)

Offers MT4 & MT5 platforms

Copy trading and educational tools for growth

Cons:

No SEBI regulation (global broker)

Currency conversion charges may apply

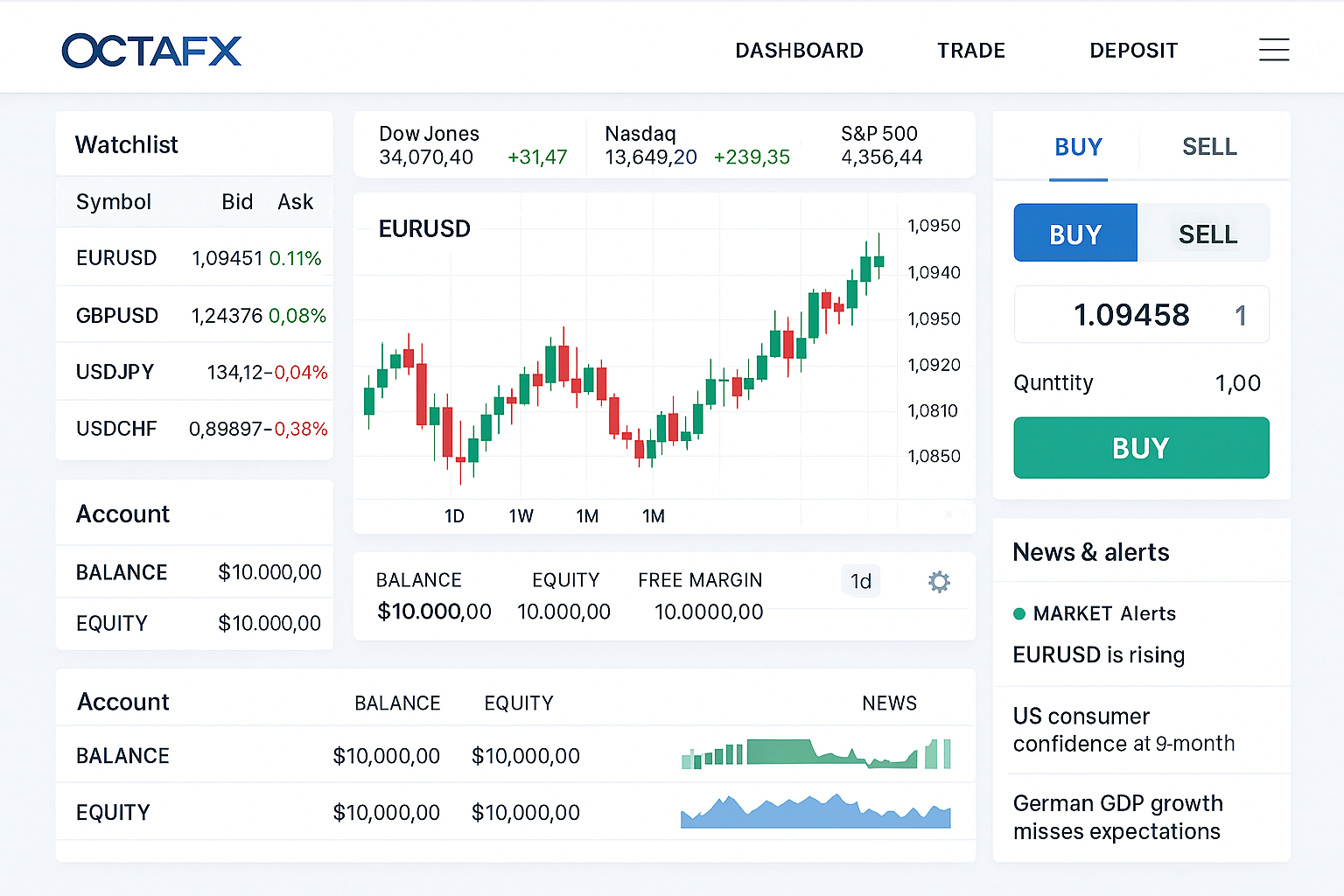

3. OctaFX

Why It Stands Out:

Due to very tight spreads and excellent customer service, OctaFX has gained very rapidly in India. The app is simple and best for beginners.

Key Features:

No commissions

Customer service from 24:00 to 5:00

Supported: MT4, MT5, and cTrader

Cashback offers and bonuses

Best For: Tight-budget traders and bonus lovers.

Pros:

Tight spreads and no commissions

MT4, MT5, and cTrader support

Cashback and bonuses

Cons:

No SEBI regulation

Limited asset classes outside forex

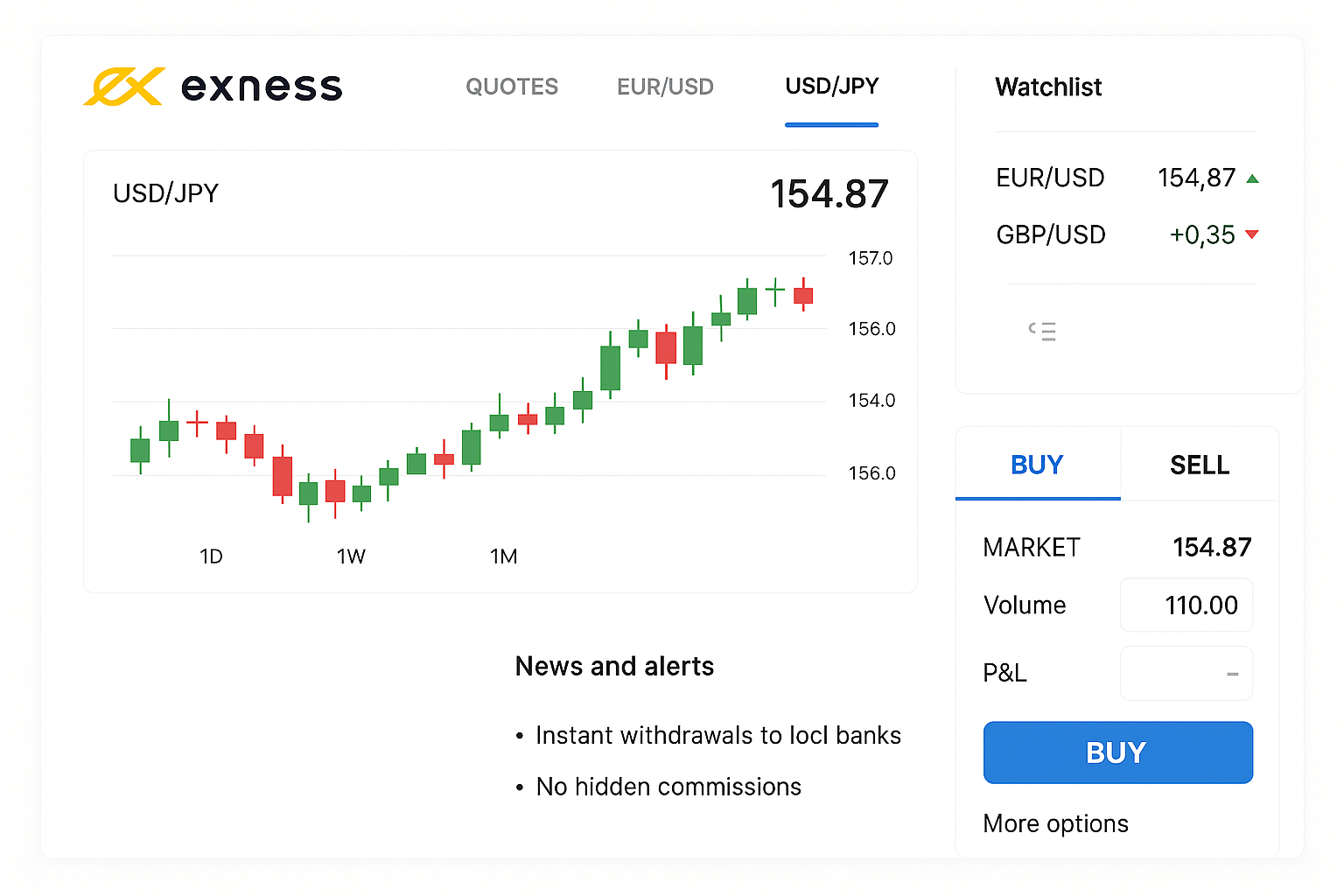

4. Exness Trader

Why It Stands Out:

Ultra-fast execution, up to 1:2000 leverage, and a highly intuitive mobile trading experience make Exness a serious player on the scene. It is equally renowned for its transparency and have funds reach clients' accounts immediately.

Key Features:

Regulated by CySEC and FSA

Instant withdrawal system

Real-time price alerts

No hidden commission

Best For: Scalpers and day traders.

Pros:

Instant withdrawals and fast execution

Regulated by CySEC and FSA

Offers micro and standard accounts

Cons:

No SEBI registration

Advanced features may overwhelm beginners

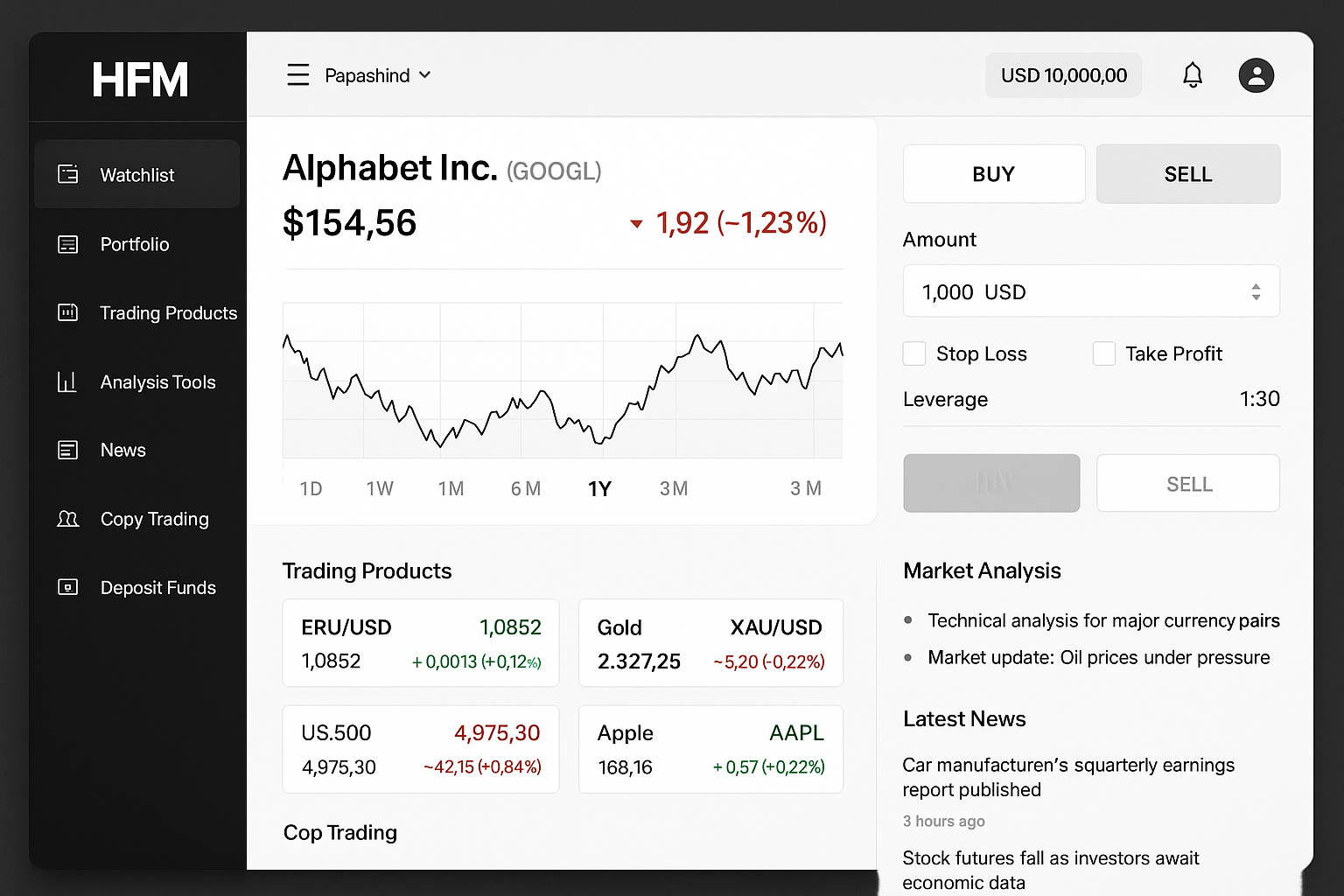

5. HFM (HotForex)

Why it Stands Out:

HotForex one of the best known names in the industry and has a range of account types, including Zero Spread and Premium accounts. Their educational offerings are perfect for Indian traders wanting to build their skills.

Key Features:

Regulated by FCA & DFSA

Leverage of up to 1:1000

Educational videos & webinars

Copy trading with HFcopy

Best For: Beginners and intermediate traders.

Pros:

FCA regulated, trusted globally

Multiple account types (Zero Spread, Premium)

Extensive educational materials

Cons:

Lacks SEBI registration

Global account setup may confuse new users

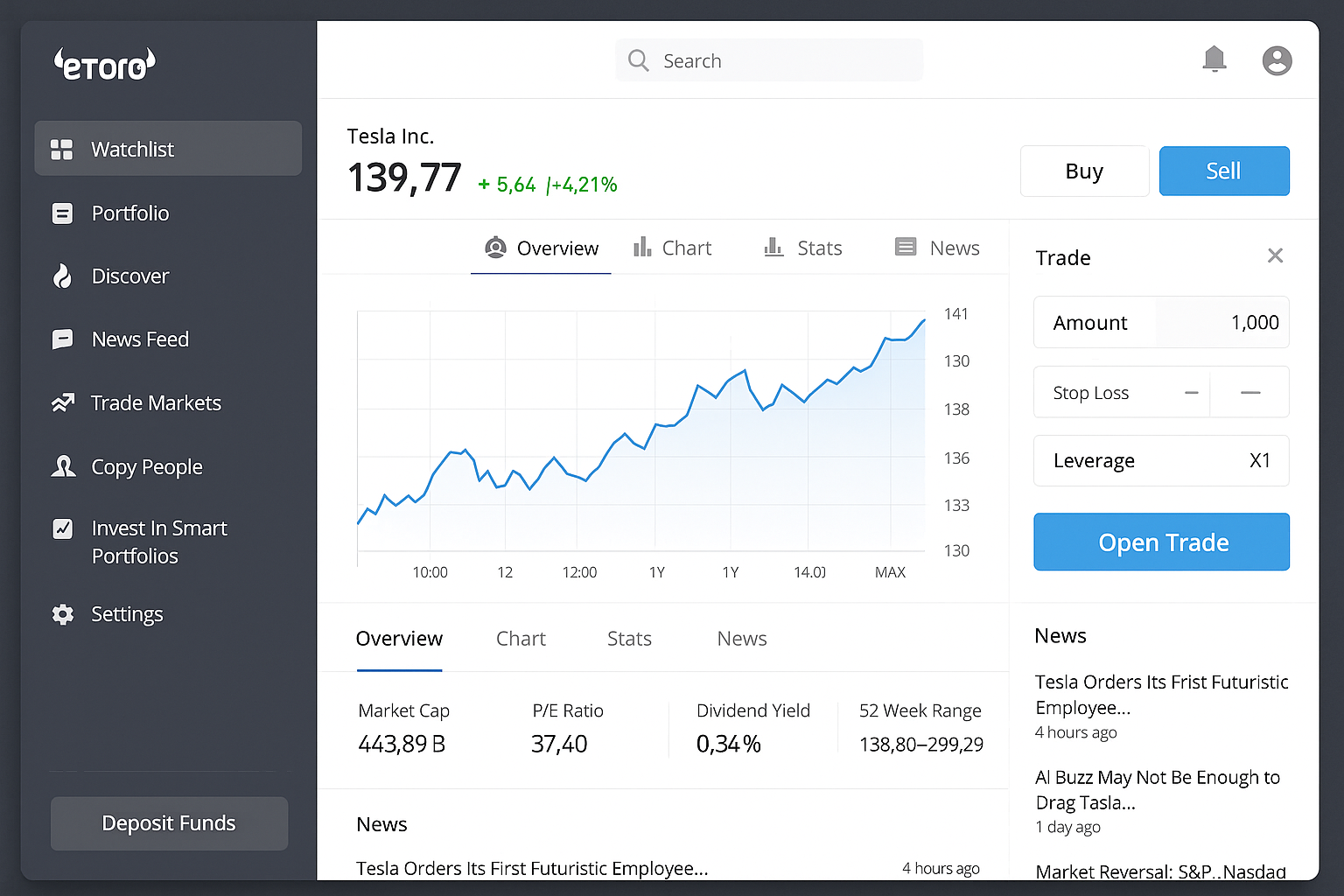

6. eToro

Why it Stands Out:

eToro is a leader in social trading. With a user-friendly mobile interface, traders can copy the strategies of top global traders with just a tap.

Key Features:

Regulated by the FCA, CySEC, ASIC

CopyTrader & social feeds

Access to forex, crypto and stocks

No commissions on most trades

Best For: Passive investors and social trading enthusiasts.

Pros:

Strong social trading ecosystem

Copy top traders in one click

Regulated by FCA, ASIC, CySEC

Cons:

High minimum deposit ($50)

Not SEBI regulated

ALSO READ: 10 Best Intraday Telegram Channels for Traders in 2025

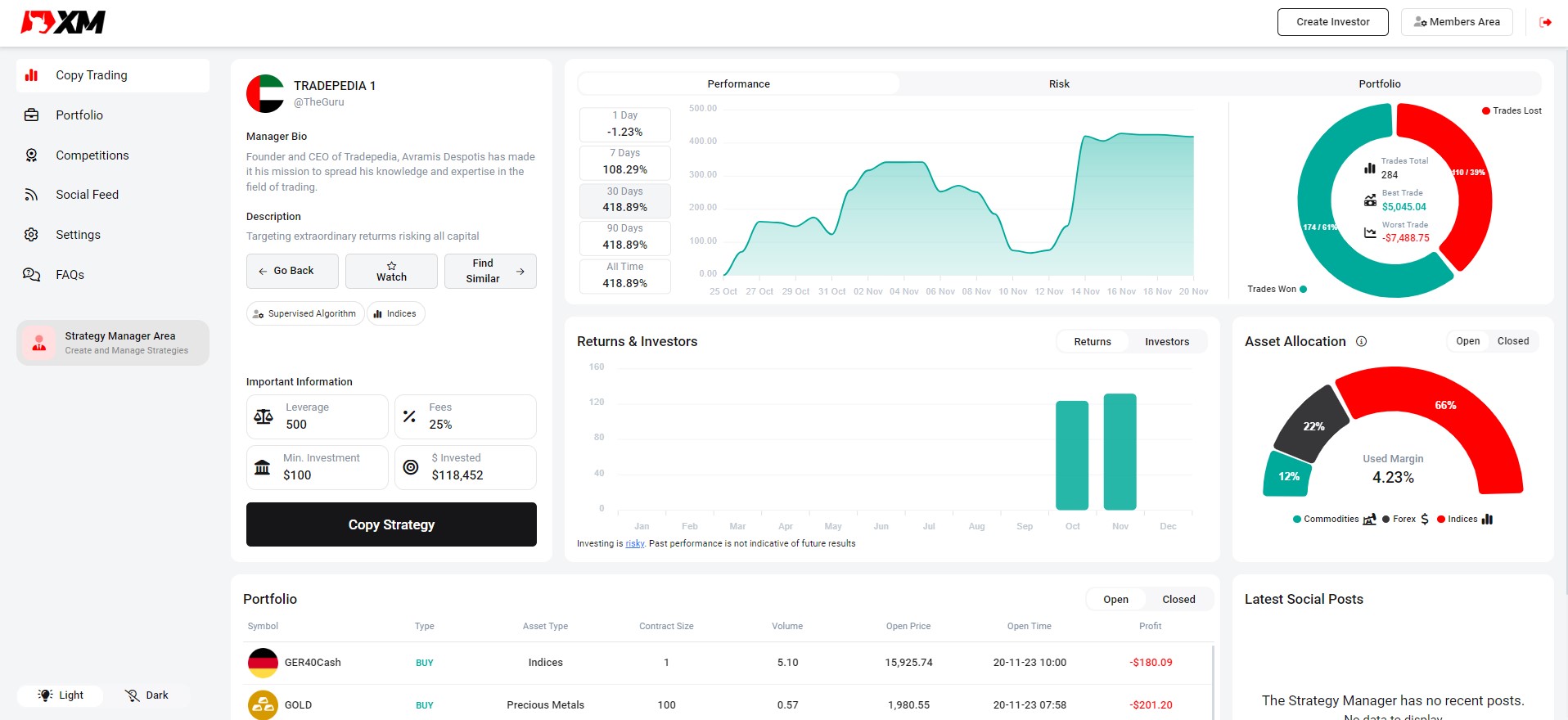

7. XM Forex

Why it Stands Out:

XM stands out for its low minimum deposit and educational resources tailored to beginner forex traders. It provides free webinars in Hindi and English.

Key Features:

Tight spreads from 0.0 pips

Free VPS & bonuses

MT4/MT5 support

Trade over 55 currency pairs

Best For: Learning traders and small-budget users.

Pros:

Very low $5 deposit

Hindi/English webinars for Indian traders

Tight spreads from 0.0 pips

Cons:

No SEBI regulation

Withdrawals may take time

8. TradingView

Why it Stands Out:

While not a forex broker itself, TradingView is the most trusted charting tool that integrates with top brokers. It’s ideal for Indian traders needing technical edge.

Key Features:

Smart drawing tools

Script-based strategy testing

Community trade ideas

Broker plug-in support

Best For: Technical traders and swing traders.

Pros:

Most powerful charting tool available

Community trade ideas & scripts

Broker integration support

Cons:

Not a trading broker itself (analysis only)

Subscription required for advanced features

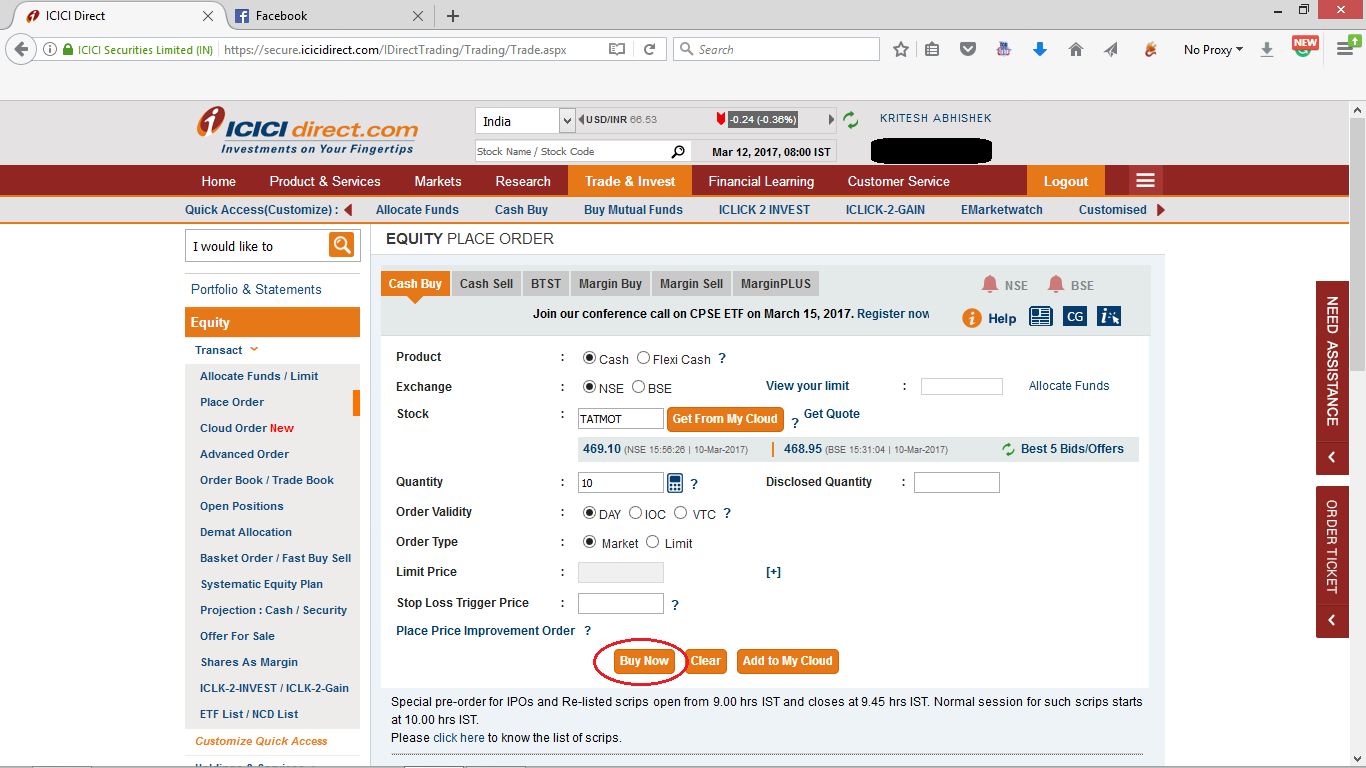

9. ICICI Direct

Why it Stands Out:

One of India’s largest financial institutions, ICICI Direct offers currency derivative trading via a mobile app. It's best for those who want to stay 100% within SEBI-regulated platforms.

Key Features:

Safe & trustworthy

Linked to ICICI bank account

Currency futures & options

24/7 customer care

Best For: Traditional investors and bank-linked traders.

Pros:

Fully SEBI compliant and bank-backed

Linked to ICICI Bank account

Safe, secure, and trusted by Indians

Cons:

No support for global currency pairs

Charges may be higher than online brokers

10. Angel One

Why it Stands Out:

Angel One has easy-to-use platforms and allows for currency derivatives in INR currency pairs. It's one of the most popular trading apps in India.

Key Features:

Easy app experience

Custom alerts and filters

Easy fund transfers

SEBI registered

Best For: First time forex derivatives traders.

Pros:

SEBI regulated, highly trusted

₹0 account opening

User-friendly app with alerts and tools

Cons:

Only supports INR forex pairs

Fewer research tools than some global apps

ALSO READ: Best Crypto Mining Telegram Bot (2025): Top Picks for Easy and Profitable Mining

How to Choose the Best Forex Trading App in India

Selecting the best forex trading app is necessary for a trustworthy and seamless trading experience. There are five main factors to help in your decision-making process:

1. Regulation

Select forex trading apps that are regulated by SEBI, FCA, or CySEC to guarantee your safety and compliance.

2. Low Spreads & Fees

Avoid apps with high spreads and commissions. Use your best judgment to select apps without hidden fees and costs.

3. User-friendly & Navigation

While trading on your mobile device, consider apps that are user-friendly, offering a clean and responsive interface and easy navigation.

4. MT4/MT5 & Tools

Check if the apps allow MT4/MT5, including advanced charting options, and good technical analysis tools.

5. Local Payment Methods

Use only the apps that allow for deposits in INR with local payments through UPI or NetBanking and fast withdrawal services.

Pro Tip: Consider using a demo account to practice how to trade either with fake funds or by borrowing from your broker.

Legal Status of Forex Trading in India

In India, forex trading is legal only when you trade against the Indian Rupee (INR). These pairs will include USD/INR, EUR/INR, GBP/INR, or JPY/INR when traded through SEBI regulated brokers.

For instance, as a retail trader in India, retail trading foreign currency pairs like EUR/USD or GBP/JPY is prohibited under Indian law unless you escalate to international platforms.

Safety Tips for Forex Traders in India

Trading on the foreign exchange markets can offer up some lucrative gains, but it can also be dangerous to your funds and potentially ruin your trading experience. Consider the following safety guidelines:

1. Only Trade with Regulated Brokers.

This should be the first and foremost principle that you use. Trade with SEBI regulated brokers in India or - globally licensed Forex brokers (such as FCA, CySEC etc.). Once you trade with a licensed broker you will have some level of legal recourse for complaints, and transparency in your trading.

2. Secure Your Account.

Always enable 2FA (Two-Factor Authentication), have strong passwords, and never share your login details with anyone to protect your money.

3. Avoid High Leverage as a Beginner

Although it looks enticing, leveraging up your account is high-stakes trading, and there are many factors that come into play. If you must, start low and use low leverage until you are comfortable trading on a larger scale.

4. Practice on a Demo Account.

Once you have found a solid and regulated broker, check and see if they offer a Demo Trading account to reduce costly mistakes.

5. Watch out for Scams & Fake Signals.

Neither rely upon tips in Telegram, or from fake "gurus" who offer unrealistic returns. Always check the facts first, and do your own research before you invest.

6. Withdraw Profits Regularly

You do not want to leave big amounts of money sitting idle on the market waiting for profitable positions you may not consider. Withdraw profits, regularly.

Conclusion

The world of Forex trading can definitely be profitable, but it is also risky, and the app you use can help. If you are a brand new trader, or even someone with lots of experience, it is important to choose a Forex trading app that the public trusts, has some features you would like to use and is regulated. The apps below are powerful, and are a good fit for the Indian audience in 2025.

Choose the one that you feel the most comfortable around, and always start with a demo or small amount of capital before going bigger.

Frequently Asked Questions (FAQs)

Q1. Is trading forex legal in India?

Yes, forex trading is legal in India but allowed only in currency pairs that have the Indian Rupee against another currency, for example, USD/INR, EUR/INR, GBP/INR, and JPY/INR. Also the trade is done through SEBI regulated trading platforms or Indian stock brokers.

Q2. Can I trade global currency pairs like EUR/USD from India?

No, Trading global currency pairs like EUR/USD or GBP/JPY is strictly prohibited for Indian residents through offshore brokers. Trading with offshore brokers is often seen as illegal and will violate RBI regulations for forex trading in India.

Q3. Which forex trading app is best for beginners in India?

Zerodha Kite for INR based currency pairs and OctaFX or FXTM for demo and low-budget trading pairs. Zerodha Kite introduces you to trading, educational content, and is low-cost and easy-to-use interface. OctaFX and FXTM are for beginners looking to practice before moving to the live market. These two brokers offer demo trading and have low costs.

Q4. Are forex trading apps safe in India?

Yes, as long as you trade using an SEBI registered forex trading app or one that is regulated globally by the FCA, CySEC, or ASIC; and avoiding unregulated apps or scam apps that claim unrealistic profits.

Q5. What are the minimum deposit requirements for forex trading apps?

It varies by platform. Indian apps like Zerodha have ₹0 minimum, while global platforms like FXTM and XM start as low as $5–$10. Always check terms before depositing.

Comments (0)